Table Of Content

Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria. It found a "real risk" of beer, biscuits and bread becoming more expensive if the poor harvest increases costs for producers, according to its lead analyst Tom Lancaster. The latest tracker issued by the Association of British Insurers (ABI) showed a 1% increase on the previous three months to £635. Challenges will involve spending a certain amount on a range, such as its BBQ food offering, or type of product, such as plant-based food. Customers who complete the "challenges" will be handed extra Clubcard points. The supermarket giant said it was working with AI company EagleAI to offer the "hyper-personalised" promotion.

Type of home loans to consider

That’s OK — play with the variables to help you figure out your next step. You could shop for a lower rate or opt for more time to pay back the loan. You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. Edit these figures by clicking on the amount currently displayed. The loan type you select affects your monthly mortgage payment.

Comparing common loan types

Understand the different kinds of loans available - Consumer Financial Protection Bureau

Understand the different kinds of loans available.

Posted: Wed, 24 Apr 2024 19:36:55 GMT [source]

For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country. An ARM, or adjustable rate mortgage, has an interest rate that will change after an initial fixed-rate period. In general, following the introductory period, an ARM’s interest rate will change once a year. Depending on the economic climate, your rate can increase or decrease.

How SmartAsset's Mortgage Payment Calculator Works

This tactic can help you save on interest and potentially pay your loan offer sooner. If your down payment is at least 20% of the property price, you typically won't have to pay for private mortgage insurance (PMI), which is required by some loan types. A mortgage payment calculator helps you determine how much you will need to pay each month to pay off your mortgage loan by a specific date. One common exemption includes, VA loans, which don’t require down payments, and FHA loans often allow as low as a 3% down payment (but do come with a version of mortgage insurance). A monthly payment calculator allows you to compare different scenarios and how they might affect your budget. Referring to the previous example, maybe $300 per month is too costly for you.

The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it. Most home loans require at least 3% of the price of the home as a down payment. Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for.

The calculator also allows you to easily change certain variables, like where you want to live and what type of loan you get. Plug in different numbers and scenarios, and you can see how your decisions can affect what you’ll pay for a home. Using the Rocket Mortgage calculator is a good way to get started. This calculator can help you determine the type of home you can afford.

Enter City and State to get a custom rate

Keep in mind, while you can pay off your principal early, in some cases there may be a pre-payment penalty for paying the loan off too early. An Adjustable-rate mortgage (ARM) is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan, based on the fluctuation of an index. Lenders may charge a lower interest rate for the initial period of the loan.

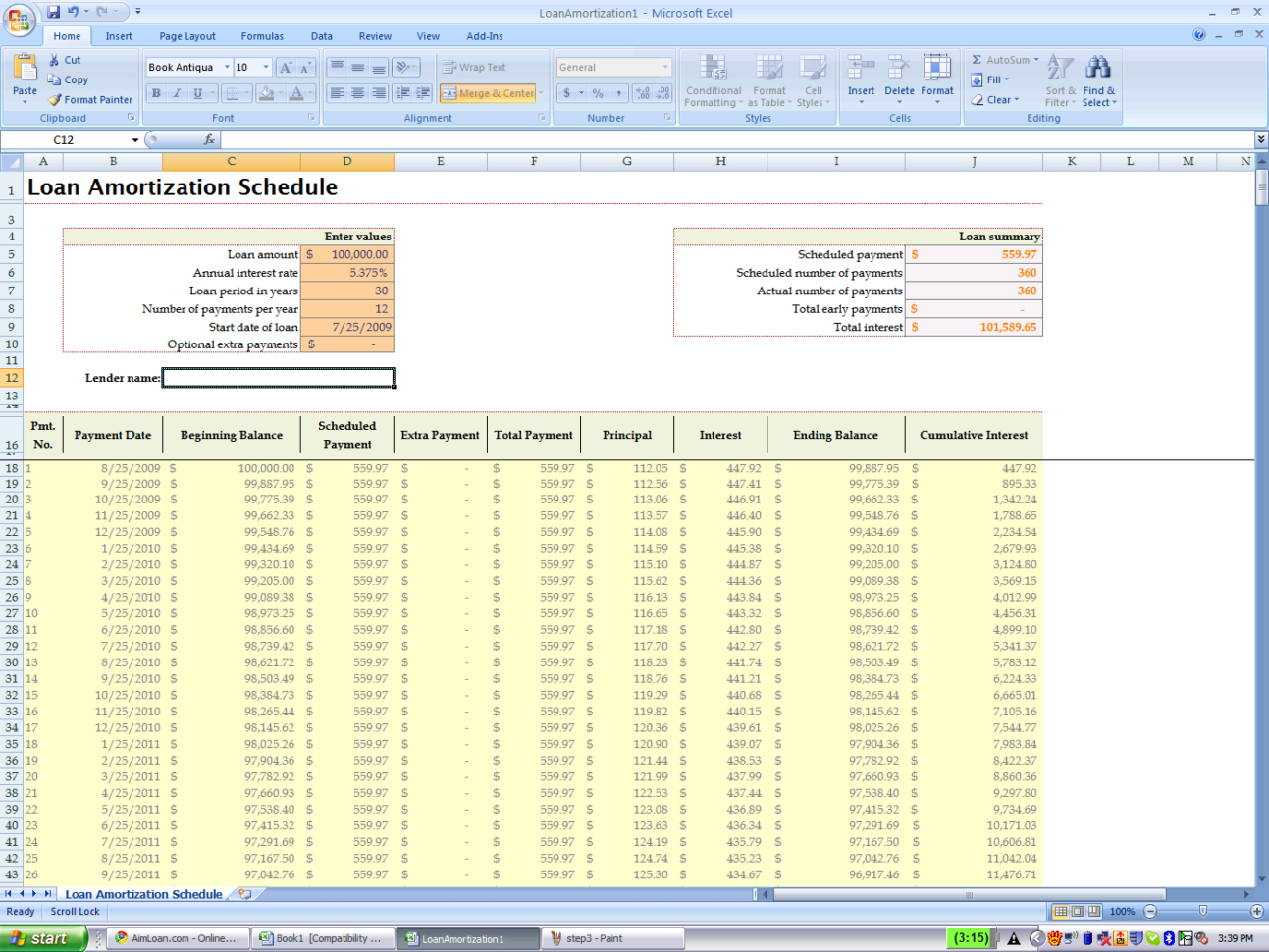

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. The predictions come just as the rate of price increases on many food items begins to slow as inflation falls.

Before committing to a mortgage loan, sit down with a year’s worth of bank statements and get a feel for how much you spend each month. This way, you can decide how large a mortgage payment has to be before it gets too hard to manage. Amortization is the mathematical process that divides the money you owe into equal payments, accounting for your loan term and your interest rate. When a lender amortizes a loan, they create a schedule that tells you when each payment will be due and how much of each payment will go to principal versus interest.

Aslef rejected a two-year offer of 4% in 2022 and another 4% this year, saying this was way below inflation, and was linked to changes in terms and conditions. Strikes tend to mean services on lines where members are participating are extremely affected or cancelled entirely, whereas overtime bans often lead to reduced services. Overtime bans, an action short of a strike, means some services may not be running or may be reduced as drivers refuse to work their rest days.

You would also pay off your loan in half the time, freeing up considerable resources. Depending on how much you change the home price in the mortgage calculator, it could drastically change your estimated monthly mortgage payments. You can play around with those numbers a little to figure out what kind of monthly payment you can afford. You don’t have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible. Loan term (years) - This is the length of the mortgage you're considering.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your home’s value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

The table below breaks down an example of amortization on a $200,000 mortgage. In order to receive a helpful estimate, it’s important that you input accurate information. On mobile devices, tap "Refine Results" to find the field to enter the rate and use the plus and minus signs to select the "Loan term." Under "Home price," enter the price (if you're buying) or the current value (if you're refinancing). A little math can go a long way in providing a “how much house can I afford? Many or all of the products featured here are from our partners who compensate us.

Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. Basically, swap rates dictate the pricing of fixed-rate mortgages. CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them.

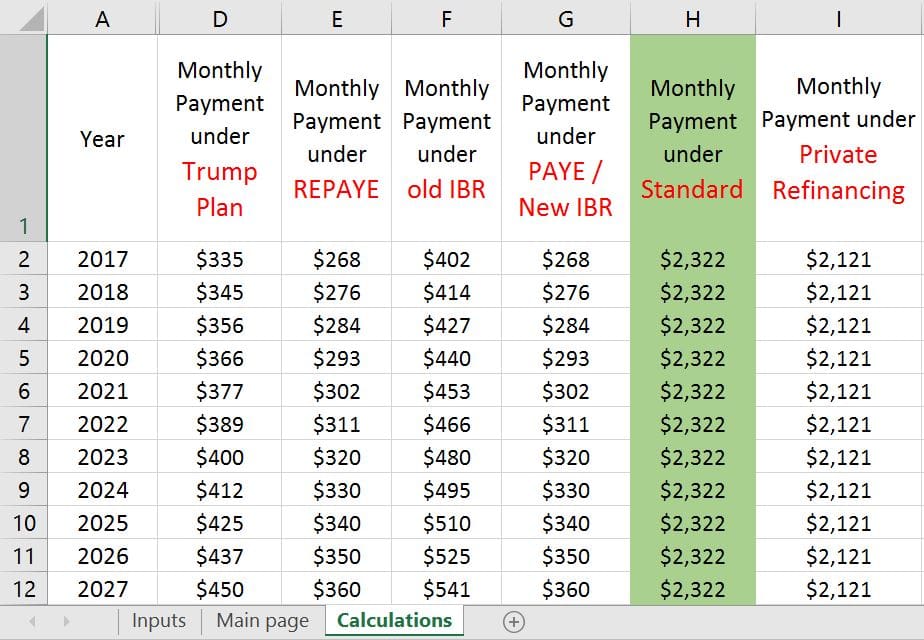

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components, property taxes, PMI, homeowner’s insurance and HOA fees. It also calculates the sum total of all payments including one-time down payment, total PITI amount and total HOA fees during the entire amortization period. Many homeowners wish to accelerate their mortgage schedule through extra payments or accelerated bi-weekly payments. A table showing the difference in payments, total interest paid and amortization period under both schemes is also displayed. For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes.

This means your interest rate and monthly payments stay the same over the course of the entire loan. A $2,000 per month mortgage payment is too much for borrowers earning under $92,400 a year, according to typical financial advice. A conservative or comfortable DTI ratio is usually considered to be anywhere from 1% to 26%, if you only include mortgage debt. A $2,000 per month mortgage payment represents a 26% DTI if you earn $92,400 per year. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home.

No comments:

Post a Comment